If you’ve paid attention to real estate trends in the last few years, you’ve no doubt seen many articles on Millennials, which the Pew Research Center defines as those born between 1981 and 1997, and how and when they’re buying homes. While in many parts of the country Millennials are not buying homes at the same rates as previous generations did when they were in their 20s and 30s, the momentum has picked up speed in the last year or so. Let’s take a look at how this generation approaches home buying.

What Prevents Millennials from Buying a Home?

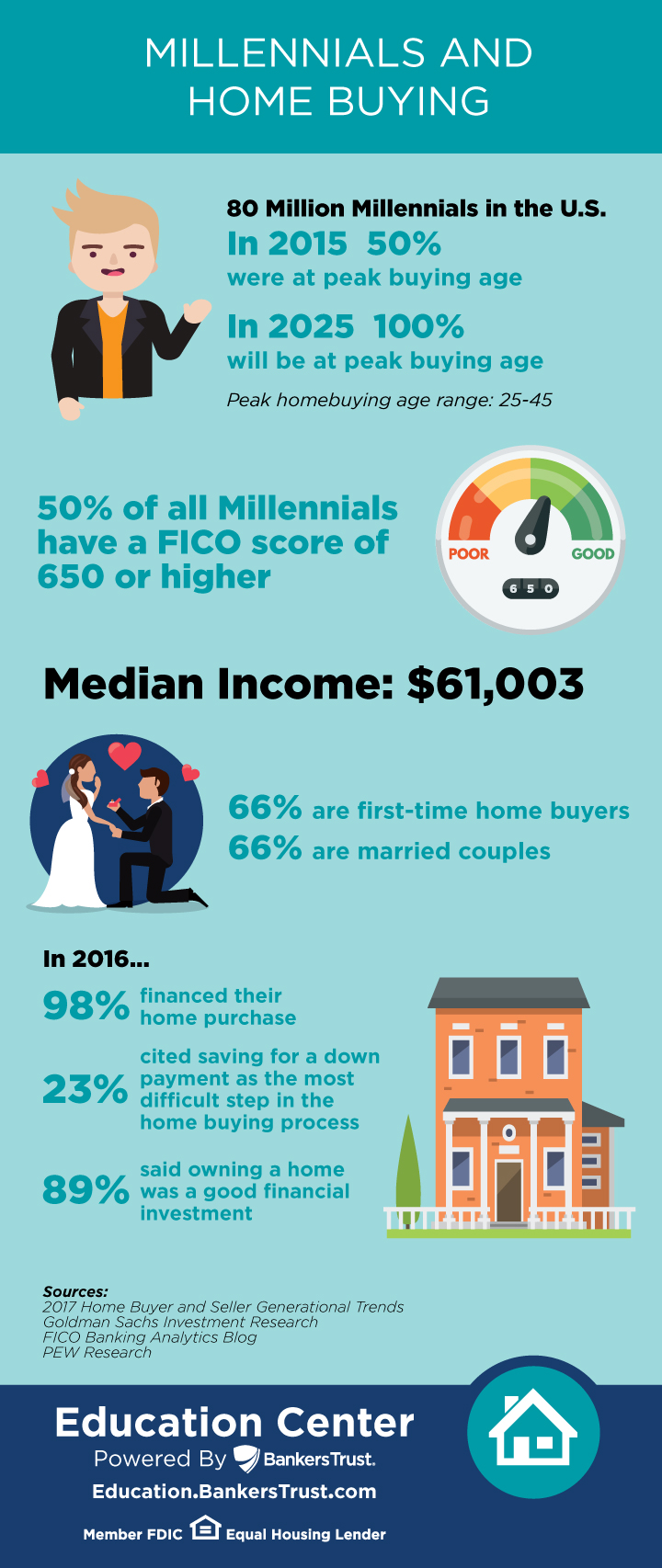

According to the National Association of Realtors’ 2017 Home Buyer and Seller Generational Trends report, 23 percent of Millennial home buyers said saving for a down payment was the most difficult step in their home buying process. It’s important to remember that many Millennials are still in their early to mid-20s and haven’t yet had a lot of time in the workforce to build their savings.

Another issue in many markets across the U.S. is skyrocketing home prices. However, these affordability issues do vary by location and are highly concentrated on the coasts. In fact, in Des Moines, Iowa, 43.6 percent of Millennials own a home, and even in Phoenix, Arizona, Millennial homeownership is between 30-35 percent.

What Spurs Millennial Homeownership?

As of earlier this year, Millennials have become the largest group of home buyers. With 85 percent of last year’s Millennial home buyers citing they believe buying a home is a good financial investment, it’s no surprise that many in this group want to begin building equity in their home. Additionally, a recent study from Apartment List found 80 percent of Millennials want to purchase real estate, verifying that the dream of owning a home is still alive and well with this generation.

Historically low mortgage rates have helped a number of people in the Millennial generation make the jump from renting to buying. Other factors this group is considering before buying include: having money saved for a down payment, getting married, and considering the long-term savings of buying versus renting. As Millennials age, we’ll begin to see higher numbers buying their first homes, with some even moving on to their second homes.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379