Many investors choose target date funds for their convenient “set it and forget it” approach, and while target date funds have many advantages, they are not right for everyone. They are not a one-size-fits-all investment solution, but they may be a viable option for investors who would like to avoid managing and adjusting their retirement plan over time. Here’s an overview of target date funds and their advantages and disadvantages.

What is a target date fund?

A target date fund is a fund offered by an investment company seeking to grow assets over a specified period. To find out which target date fund fits your timeline, begin by estimating the year you will retire. The amount of time between now and your retirement will help determine your “glide path.” Glide path refers to a formula which defines the asset allocation mix, which can be more or less aggressive and is based on the number of years left to the target retirement date.

Early in your career, it is commonly recommended you have a more aggressive investment strategy, as you have more time to recover from a loss. A more aggressive strategy may lead to higher returns – and mean higher risk – because it means more of your funds are allocated to stocks and less in bonds. As you near retirement, you may want to take a more conservative approach, and allocate more funds to lower-risk, bond funds.

One purpose of a target date fund is to automatically adjust asset allocation and risk as you near retirement to avoid large losses when you no longer have time to make it up. The structure of a target date fund allows you to simply set your retirement plan on auto pilot; however, remember your goals or needs may change and like any investment should be re-evaluated to fit your needs.

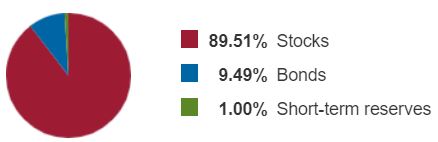

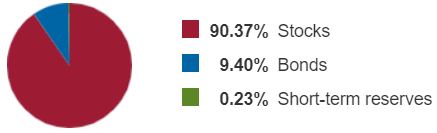

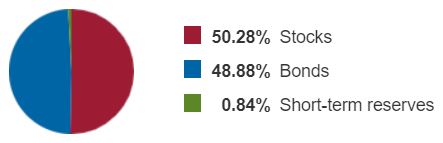

Here are a few examples of what your target date fund may look like based on your target retirement year according to Vanguard’s target date fund calculator.

If your target retirement year is 2065, your funds will likely be allocated to 90 percent or more in stocks right now. On a risk scale of one to five (one being the least risky and five being the most risky), Vanguard rates this allocation at level four.

A target date fund for the year 2045 is slightly less risky – still level four – but shows a slight shift to bonds and short-term reserves.

A target date fund for someone looking to retire in 2020 or within a couple of years may look like an even split between stocks and bonds, which is even less risky (level three).

What are the advantages of target date funds?

Target date funds allow for a diversified portfolio and the asset mix is professionally managed. Since target date funds are automatically rebalanced, you do not have to adjust your investments yourself to ensure you are moving towards a less risky asset mix as you near retirement.

What are the disadvantages of target date funds?

Target date funds come with a pre-determined risk tolerance based on your age and time until retirement; you cannot choose to take a higher or lower risk approach. Target date funds also tend to come with higher fees and may experience an insufficient inflation hedge.

Target date funds may be a good choice for inexperienced investors or anyone who does not plan to research their investments over time and manually adjust their asset mix. Speak to your financial advisor or retirement plan administrator to learn more about your options and the right fit for your goals, time horizon, and risk tolerance.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379