Have you recently received a postcard from your bank alerting you that your mortgage has been closed and they need you to call immediately to discuss an important matter? If you have, you may have received a fraudulent mailer – a popular way scammers use public information to lure you into calling them and giving them your personal information.

Here’s an overview of how to spot indicators of fraudulent mailers and what you should do if you’ve already given the scammers a call.

How do I spot a fraudulent mailer?

Fraudulent mailers containing your mortgage information are so common because the information they contain is easily accessible online. All mortgages are filed with your county and are public record, making them accessible to anyone. Because the information is easy to access, fraudulent mortgage-related mailers are sent by scammers to the masses. Luckily, they all look similar, which means if you know how to spot the red flags, you can quickly determine that it’s fraud.

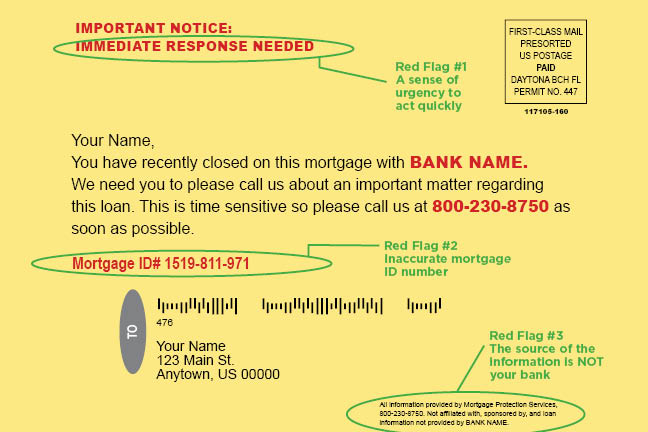

Here’s an example of a fraudulent mortgage-related mailer with all the red flags you should lookout for:

The first red flag in this example is the sense of urgency created in the first line: “Important notice: Immediate response needed.” Beware of any documents that urge you to act quickly, as scammers often use this as a tactic to get you to call immediately instead of taking the time to evaluate the legitimacy of the alert.

The second red flag is the incorrect mortgage number. Scammers typically send these notices in mass mailings, and they don’t often personalize them beyond your name and address. However, even if the notice includes your real mortgage number, it still may be fraud, as this information can also be found by fraudsters online.

The third red flag is the small print in the lower, right-hand corner that says “All information provided by Mortgage Protection Services. Not affiliated, sponsored by, or provided by [your bank name].”

What should I do if I’ve already called the number?

If you have received a fraudulent mailer, have already called the number, and believe your identity may be compromised, follow the five-step identity theft protocol below.

- File an identity theft claim at identitytheft.gov. This will begin the process recovering your identity and taking measures to prevent future identity theft.

- Notify all financial institutions you work with. This includes your bank, investment companies, insurance companies, and brokerage firms.

- Notify the three major credit reporting agencies, Equifax, Experian, and TransUnion. Place a freeze on your credit with all three agencies.

- File a police report with your local police department.

- Change all your internet banking passwords.

If you’re ever unsure if documents that appear to be sent to you from your bank are legitimate, give your banker a call or stop by your local branch.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379