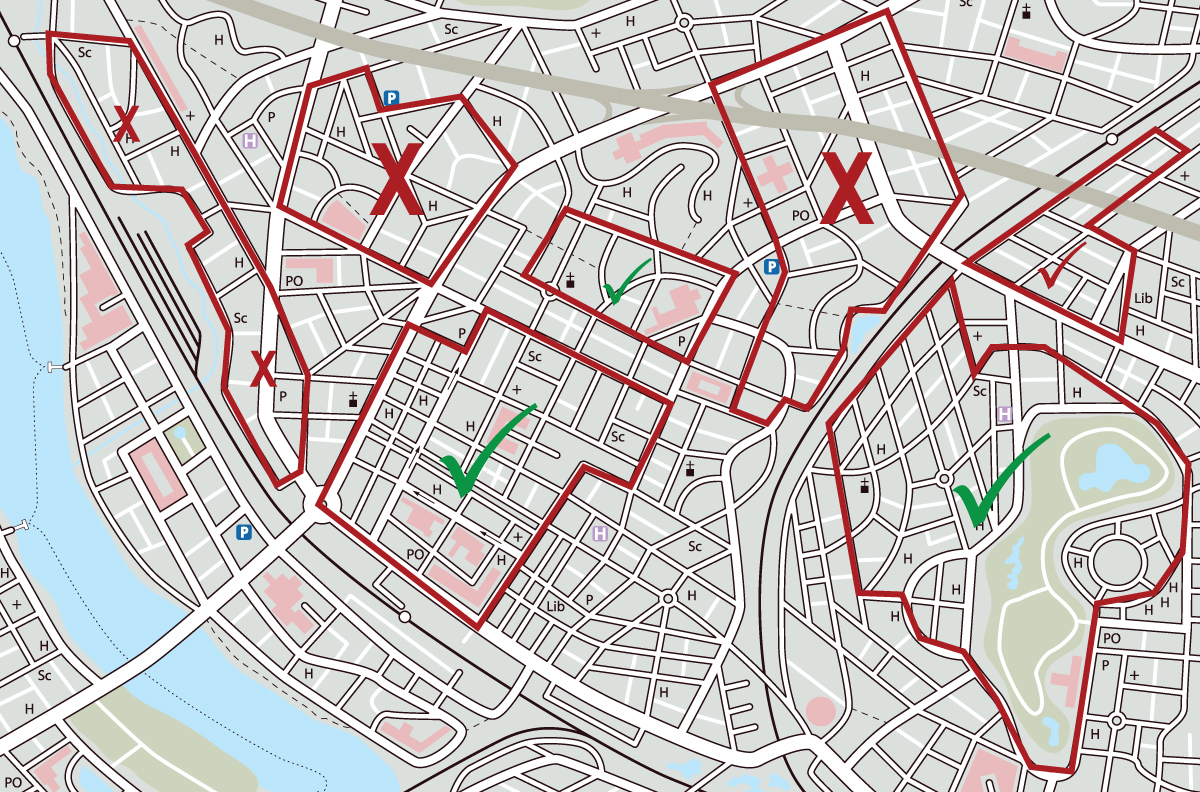

Not long ago, some financial institutions excluded individuals and neighborhoods from their business practices. This activity was referred to as “redlining,” and it resulted in millions of families without access to banking services near their place of residence or employment. It also resulted in “bank deserts” in urban neighborhoods where there were greater percentages of racial and ethnic minority residents.

Some financial institutions drew red lines on maps of their communities to identify the neighborhoods in which they did not want to open branches or accept real estate collateral located in those neighborhoods.

In 1977, the U.S. Congress enacted the Community Reinvestment Act (CRA) to end such discriminatory practices and instead require banks to serve every person and geographical area within their communities.

What this means for your community

While the CRA and banking cannot eliminate the consequences of many decades of racial and ethnic segregation, they have certainly played a very important (and often unnoticed) role in reducing poverty rates, neighborhood revitalization and stabilization, and how banks conduct community development activities in partnerships with local and governmental organizations.

CRA facts to know

1. The CRA is a driving force for banks to pursue partnerships with community-based and government organizations to solve community needs.

An example of this is the offering of Individual Development Accounts (IDA), in which the community/government agency pledges dollars to match the savings of low-income families to use as down payment to buy a home, start a small business, or obtain a degree from an academic institution. The bank holds the accounts under special rules, procedures and reporting.

Another example is loan pools, in which various banks come together to share the risk of more flexible and affordable loans for individuals with disabilities. This allows them to purchase medical or mobility equipment.

2. If your community is in need of revitalization or stabilization, banks, as well as community development organizations such as Certified Community Development Financial Institutions (CDFIs) and Community Development Entities (CDEs) can leverage the revitalization activities taking place.

For example, a bank provides a low-interest flexible loan to remove hazardous material from an old industrial site in an area targeted for revitalization. In addition, a bank employee is involved in the revitalization board or committee to provide financial expertise and the bank also offers a special loan program to incentivize small businesses to start or move operations, as well as jobs, to the area targeted for revitalization.

Between 1977 and 2017, it is estimated that banks have extended more than $769 billion in community development loans and more than $918 billion in small business loans, partially because of the CRA.

3. Banks are examined for compliance with the CRA by regulatory agencies (the FDIC, the OCC, or the Federal Reserve Board) and will be assigned with one of four ratings:

- Outstanding

- Satisfactory

- Needs to Improve

- Substantial Non-Compliance

The rating, as well as all the information concerning a bank’s level of compliance with the CRA, is public information. You can find the rating and public evaluation(s) of your bank here.

4. Credit unions are not subject to the CRA, and therefore, they are not expected to maintain the same business practices as banks regarding community reinvestment.

Why you should care about your bank’s CRA rating

A CRA rating reflects the culture and history of a bank. It is a representation of how well a bank knows its community and customers, its effectiveness in reaching and serving everyone in its community, and its leadership and commitment to community development efforts.

Bankers Trust has received consecutive “outstanding” ratings since 2001, which only 7% of all banks in the U.S. receive in any given examination. This is another way in which we demonstrate a commitment to customers, to excellence, and to the communities we serve.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379