When you’re getting ready to buy a home, one of the first and biggest steps in the process is submitting your mortgage application. While having submitted the application means “your part” is mostly over, there are a lot of steps your lender still has to take in order to approve your application.

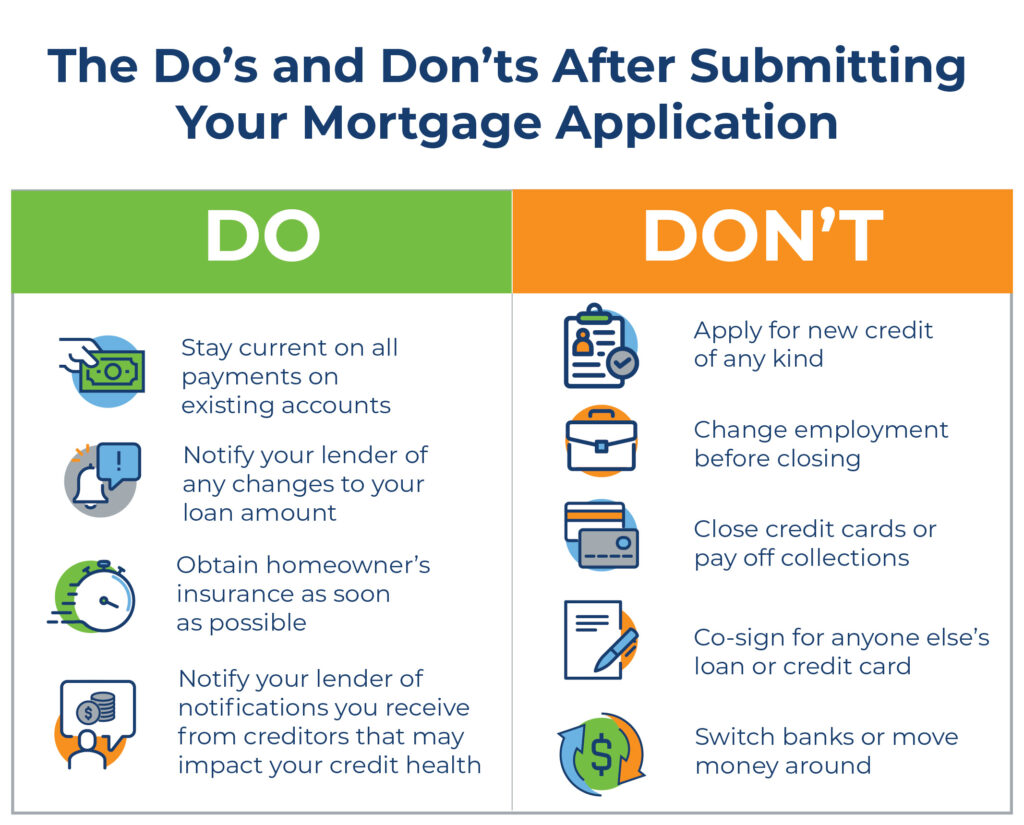

In order to help keep your loan process stay on track and avoid delays in your approval, here are some general best practices you should follow.

The Do’s

- Do: Stay current on all payments on existing accounts. If you miss payments on current accounts, your credit health may be impacted, which will impact the approval of your mortgage loan.

- Do: Notify your lender of any changes to your contract or loan amount. If you decide to make a smaller or larger down payment than originally discussed or make any other changes to your loan amount, communicating this sooner can avoid delays in approval and even closing on your loan.

- Do: Research and obtain a company for homeowner’s insurance as soon as possible to avoid last minute delays. Obtaining insurance is the homebuyer’s responsibility, and it’s best if done well before the loan closing to avoid delays.

- Do: Contact your lender if you receive anything in the mail from a creditor or collection agency that you think may affect your credit score as it may impact loan approval.

The Don’ts

- Don’t: Apply for new credit of any kind, as this can cause a temporary decrease in your credit score. Opening new accounts will also change your debt-to-income ratio which could have a negative impact on our loan approval.

- Don’t: Change employment prior to closing. It’s important you can show consistent employment and income throughout the loan approval process.

- Don’t: Pay off collections or close credit card accounts, as this can also cause a temporary decrease in your credit score.

- Don’t: Co-sign for anyone else’s loan or credit card. This will indicate you may be responsible for another individual’s debt and impact your own ability to obtain credit.

- Don’t: Switch banks or move money around. Similar to maintaining the same employer, it’s important to show consistent funds in your account throughout the loan approval process.

If one of the don’t items becomes something you must do, contact your lender first. They can often help you reduce the impact it has on your home buying process. Follow these tips as closely as possible so that your closing and moving in to your new home goes without a hitch!

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379