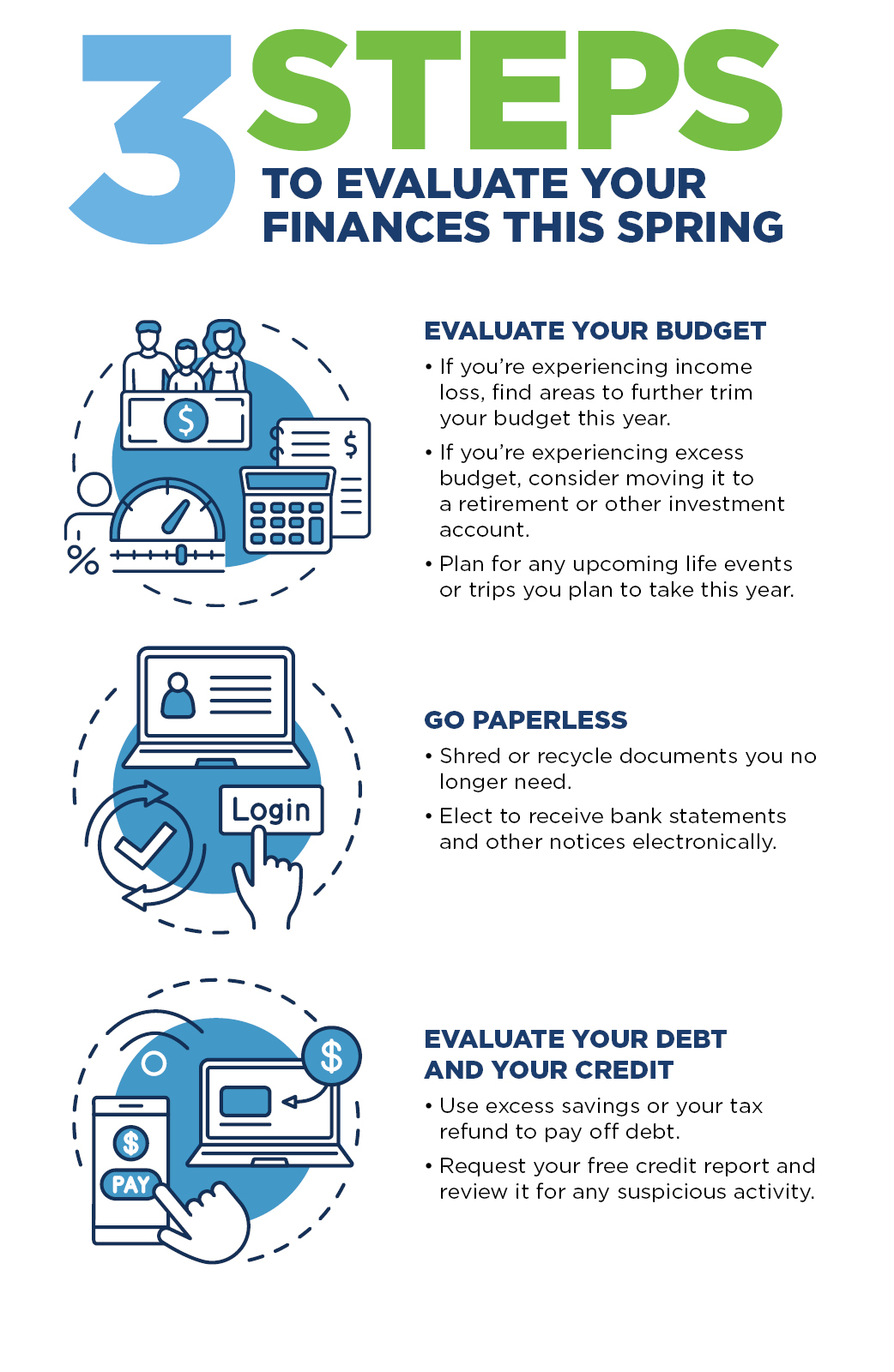

A common New Year’s resolution you may have made this year is to manage your finances better. And especially after 2020, your greater financial picture may look much different than it did in the past, warranting a closer look at your budget and other financial habits. With spring right around the corner, it’s a great time to evaluate your finances and give them a good “spring cleaning.” Here are three steps to get started.

Evaluate your budget

Evaluate your budget

While some people are experiencing tighter budgets because of unexpected unemployment, others are experiencing excess savings as a result of staying home and spending less on usual entertainment. Both situations can have long-term effects on your greater financial picture. If you’re experiencing income loss, find areas to further trim your budget this year. If you’re experiencing excess budget, consider where your funds could be best used, such as moved to a retirement or other investment account, or put towards a child’s college fund.

Additionally, consider if there may be any upcoming life events or trips you plan to take this year. Closely reviewing your spending now can help prevent any surprise expenses and last-minute budget adjustments later.

Go paperless

In the spirit of spring cleaning, it may be a good idea to sort through old documents and recycle things you no longer need. Items such as old receipts, old utility bills or bank statements that are more than a few years old should be shredded and disposed.

The pandemic pushed us into an increasingly virtual and digitized world, and there’s never been a more appropriate time to move financial documents into a digital space. To cut down on clutter and keep documents more organized, consider electing to receive bank statements and other notices electronically. Scan other existing print documents and save them digitally as well. Just remember to create a system so you can find them when needed and back up all important documents using an external hard drive.

Evaluate your debt and your credit

Especially if you’re experiencing an increase in savings or are expecting a hefty tax refund, consider paying off debt. This may leave you better prepared for upcoming expenses or events later in the year. It could also positively impact your credit score, which you might want to check if you haven’t done so in a while. You can request your credit report from any of the three nationwide credit bureaus – Equifax, Experian and Transunion – for free without impacting your score.

Whether in your home or in your finances, spring cleaning can help you prepare for the new season. Especially after a year of many unexpected events, it’s important to ensure your finances are all in order and you’re set for a successful year!

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379