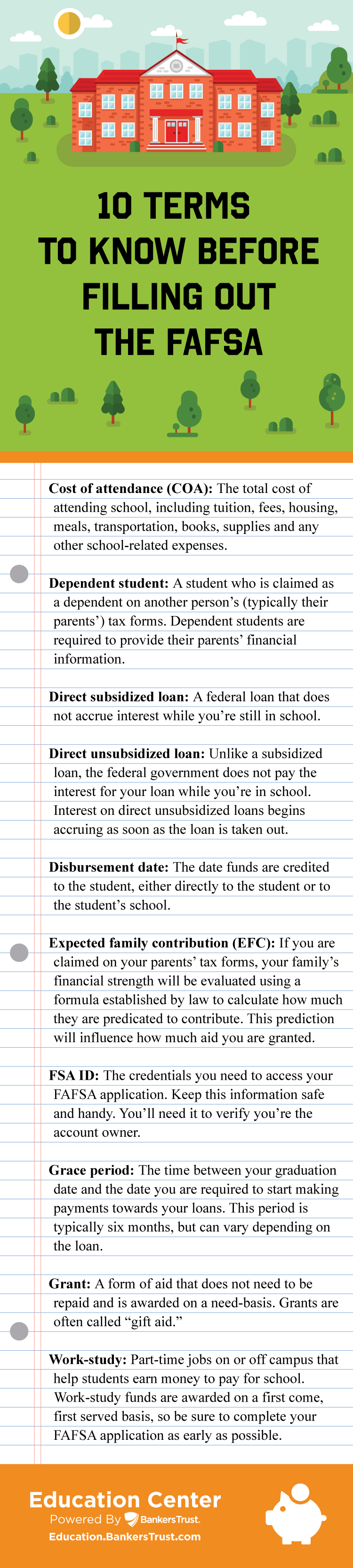

Filling out FAFSA, or a Federal Application for Federal Student Aid, should be on every student’s annual to-do list. By filling out the application, you’ll learn if you qualify for federal financial aid for college or graduate school expenses.

If you’re a first-time applicant, you may come across some unfamiliar terms. Here’s a list of the top 10 FAFSA terms to know. Even if you’re a returning applicant, you may benefit from a refresher!

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379