While buy-now-pay-later (BNPL) products, such as Afterpay, Klarna and Affirm, have been available for years, their popularity skyrocketed during the pandemic-induced influx of online shopping. As the name suggests, BNPL allows you to purchase products and services right away, while delaying payment until a later time, usually over a series of payments billed to your debit or credit card. Let’s dive into how BNPL works, the pros and cons, and what you should keep in mind if you choose to use it.

How BNPL works

BNPL products are mostly seen on retail websites, but they’re also available at some physical stores. When shopping on sites that offer BNPL, the option will appear when you check out. You’ll see your total broken down into several payments and the due dates for each.

For example, if your order total is $100, and the payment plan is in four installments with the first one due right away, you only pay $25 that day to receive the goods and the remaining three payments of $25, plus interest if it is being charged, are scheduled. How much interest is charged and the time between payments vary between BNPL providers, but the most common is two weeks between payments. So in this example, you would be responsible for paying $100, plus interest, over the course of six weeks.

Applying for BNPL programs is done online during the checkout process. After you provide your personal information and a payment method, the provider either approves or denies the application immediately. Approval qualifications vary between providers, but unlike credit cards, they commonly approve requests even from individuals with poor or nonexistent credit histories.

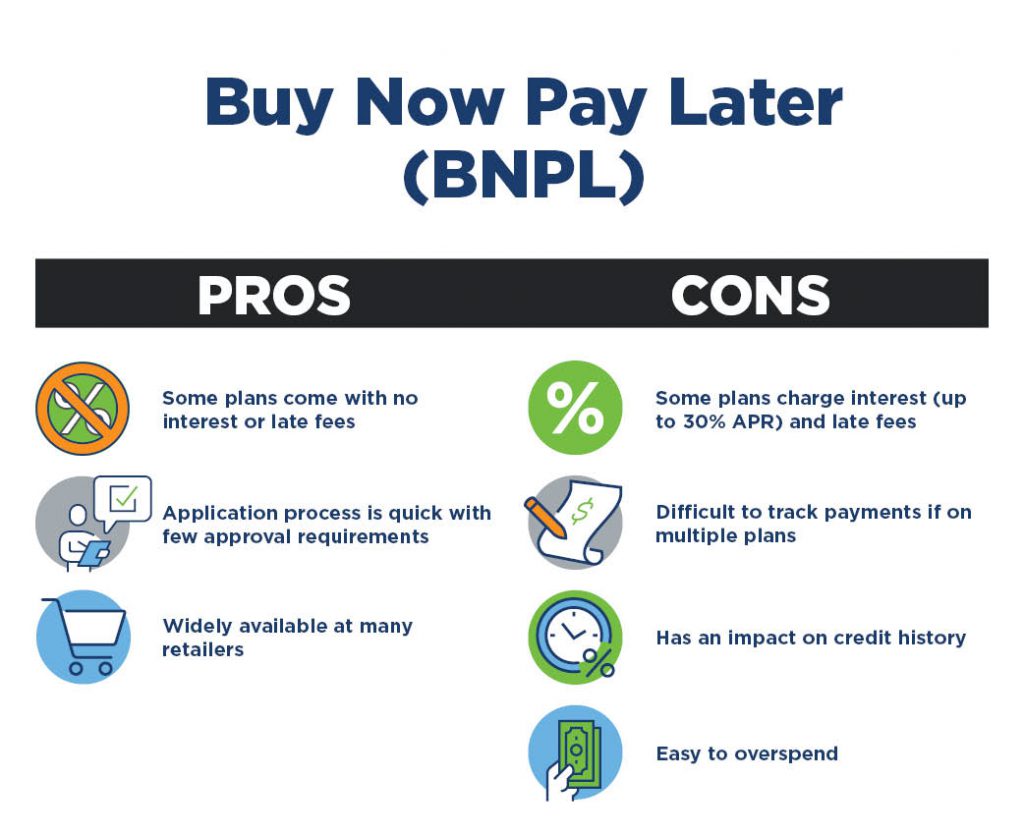

Pros and cons of BNPL

BNPL products can be very convenient, but they do have drawbacks. Here’s a breakdown of the main pros and cons.

What you should keep in mind when using BNPL

If you decide to use BNPL products, the most important thing to keep in mind is that it is a form of debt, and if used improperly, it will negatively impact your credit score. BNPL providers are now required to report all users to credit bureaus, so all information regarding your BNPL activity, including the number of payment plans you’re on, if you’ve been late to make payments, and more will be factored into your credit score.

Additionally, some behavioral researchers warn of the “psychological pitfall” behind BNPL. Payment plans often make products and services seem more affordable, and many individuals fail to realize they are taking out loans to pay for them. This makes it easy to overspend, run into high interest and late fees, damage credit, and impact the approval of other loans such as mortgages and auto loans. Therefore, if you decide to use BNPL, it’s important you only purchase items you can truly afford, and you avoid having several payment plans at once, so you can more easily track due dates and how much you’re really spending.

The bottom line

BNPL can be a convenient tool – and even a lifeline – for individuals who must make a purchase but don’t have the funds on hand or the credit history to obtain a more traditional loan. However, it can also come with negative consequences if used irresponsibly. Keep these guidelines in mind the next time you see BNPL as a payment option.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379