Now that you are saving for retirement, are you monitoring your account on a regular basis? Each quarter you should receive a statement that shares updates on your 401(k)’s performance – either electronically or mailed to your home address – and it’s important to review the information it contains to keep up to date on your total savings, interest earned, estimated retirement income and more.

Let’s walk through how to read and understand your quarterly 401(k) statement. Please note, while I’m providing an example of a 401(k) statement produced by Bankers Trust, the instructions for understanding sections of the statement are applicable to most statements produced by other providers.

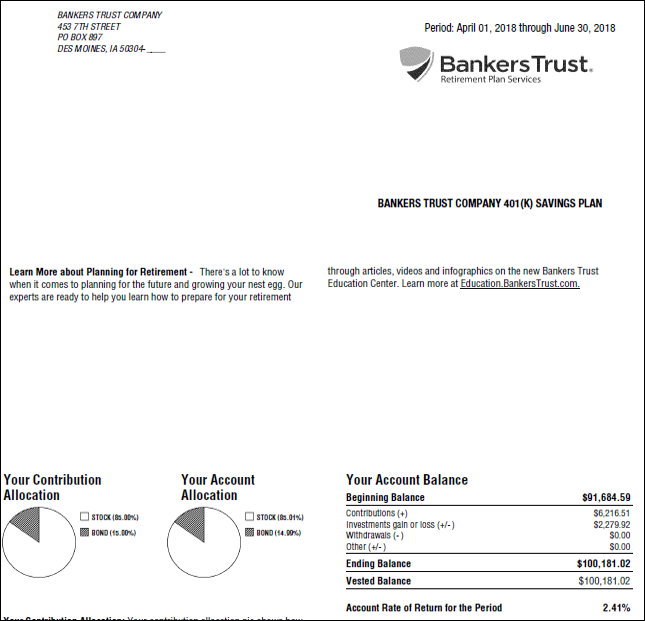

The Account Balance section of your 401(k) statement

Your statement will include an Account Balance section, typically on the first page. This section will show your:

- Beginning balance, which is the total funds in your account at the start of the quarter

- Your contributions and any employer contributions

- Investment gain or loss

- Amount withdrawn, usually in the form of a loan or distribution

- Ending balance for the quarter

- Vested account balance

- Your account’s rate of return for the quarter, which depends on market conditions and your own asset allocation

The part of this section that causes most confusion is vested balance. Your vested account balance is how much you own. You are always 100% vested in any money that you contribute to the plan, whether they be pre-tax, Roth after-tax deferrals, or incoming rollovers. Any employer contributions you receive may be subject to a vesting schedule, which means, depending on your employer’s policies, a certain amount of time must pass before you own their contributions to your fund.

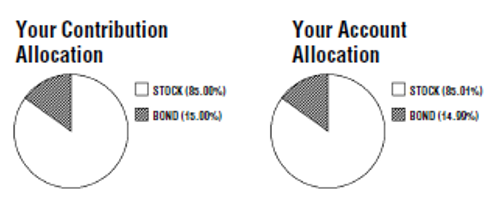

Also within the Account Balance section, you may find charts depicting your contribution allocation and account allocation. The contribution allocation chart shows how you want your money invested. The account allocation chart shows how your account is actually allocated. The charts may be different if you are investing new contributions in different funds or different amounts than the money that is already in your account. This may also be an indication you need to rebalance your portfolio since your investments are growing at different rates and may no longer suit your risk comfort level.

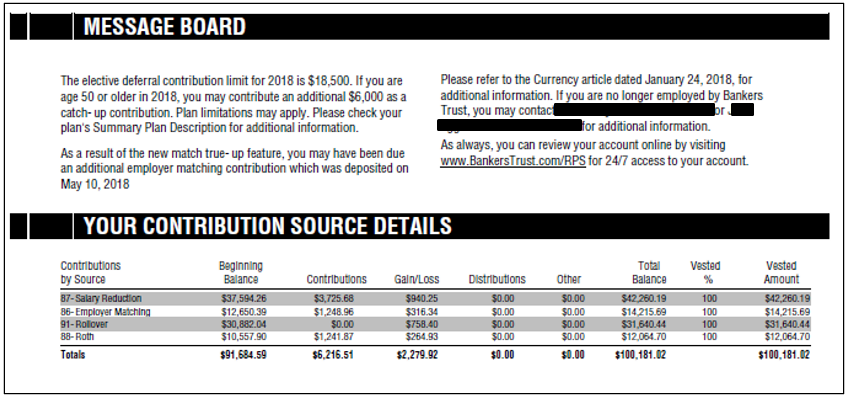

Messages and contribution source details in your 401(k) statement

Your 401(k) statement may include an important message from your provider, which will be located in the Message Board section or similar. Your statement should also include a breakdown of where your account funds came from and your vesting for each source, in the Contribution Source Details section. This breakdown usually includes your salary reduction (pre-tax deferrals), employer match, rollover funds (from a previous employer’s plan or your IRA), and Roth funds (after-tax deferrals).

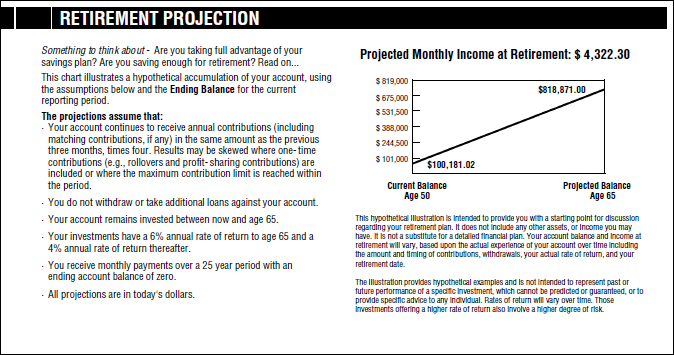

The Retirement Projection section of your 401(k) statement

As you look at your account balance, you may be wondering how it translates to monthly income in retirement. The Retirement Projection section of your 401(k) statement should outline a projected account balance at age 65 and an estimated monthly income over the course of 25 years.

Keep in mind, this projection is only an estimate and is based on several assumptions, such as that you will make the same deferral and match percentages, you won’t make early withdrawals, and you will earn a projected 6% annual rate of return.

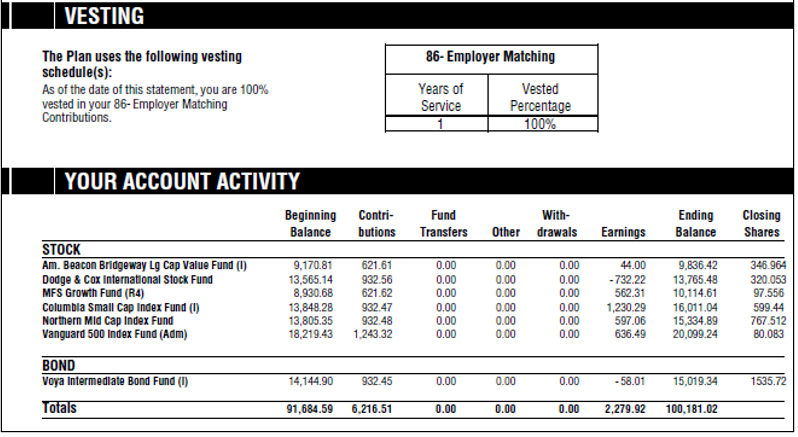

Vesting and Account Activity information in your 401(k) statement

Your 401(k) statement should make it clear what percentage of your funds are vested, which usually depends on your total years of service at a company. Additionally, your statement should provide a complete list of stocks and bonds you are investing in and your total balances, withdrawals and earnings in each. If you would like to make changes to the funds you’re investing in, contact your retirement plan provider.

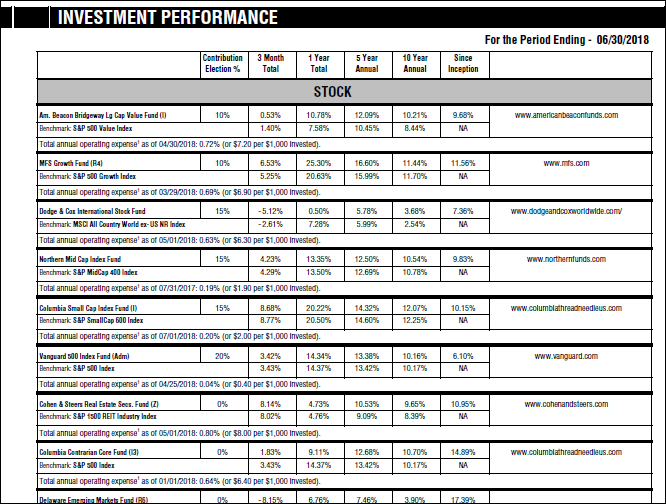

The Investment Performance section of your 401(k) statement

If you would like to evaluate other funds to invest in, you can find a full list of investment options available to you, and their performance the past one, five and 10 years, in the Investment Performance section of your 401(k) statement. Within the list, you can also find how much of your account is allocated to each fund and each fund’s performance the past one, five and 10 years.

Be sure to review your statement each quarter and ask your plan administrator or your plan’s relationship manager if you have any questions about the information. Your retirement plan may be one of the largest assets you will have in life, so it’s important you stay well informed of its progress and consult with a financial advisor to make sure you’re on the right track!

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379