Did you recently receive your annual escrow analysis statement from your mortgage lender and have questions about what it means and any actions you may need to take? This guide explains the purpose of the analysis, how to read your statement, and what it means if your account shows a shortage or surplus.

What is an escrow account and escrow analysis?

An escrow account is used by homeowners and mortgage lenders to ensure adequate payments are made on homeowners’ insurance and real estate taxes. Because your property tax and home insurance rate can change over time, so can your monthly escrow payment, so it’s important your mortgage lender does an annual analysis of your escrow account to make sure you aren’t paying too much or too little.

Once a year, your lender will review your account for current tax and insurance payments, your account balance, and any recent tax and insurance disbursements they have made with your escrowed funds. Your lender then sends you a statement that states whether your monthly payment will remain the same or go up or down next year. This statement may also inform you of any shortages or surpluses in your account.

What does it mean if I have a shortage or surplus in my escrow account?

If your escrow analysis statement shows the lowest projected balance in the year ahead is less than your minimum balance, you have a shortage. This means your tax and insurance payments have increased, and therefore, so will your monthly payments in the year ahead.

If your lowest projected balance is more than your minimum required balance, you have a surplus. The surplus funds may either be applied to future payments or sent to you in the form of a check.

How to read your escrow analysis statement

Once a year, you’ll receive a three-page escrow analysis statement. Here’s a breakdown of what to look for on each page. Note that statements may look different among loan servicing companies, and below is an example of Bankers Trust escrow analysis statements.

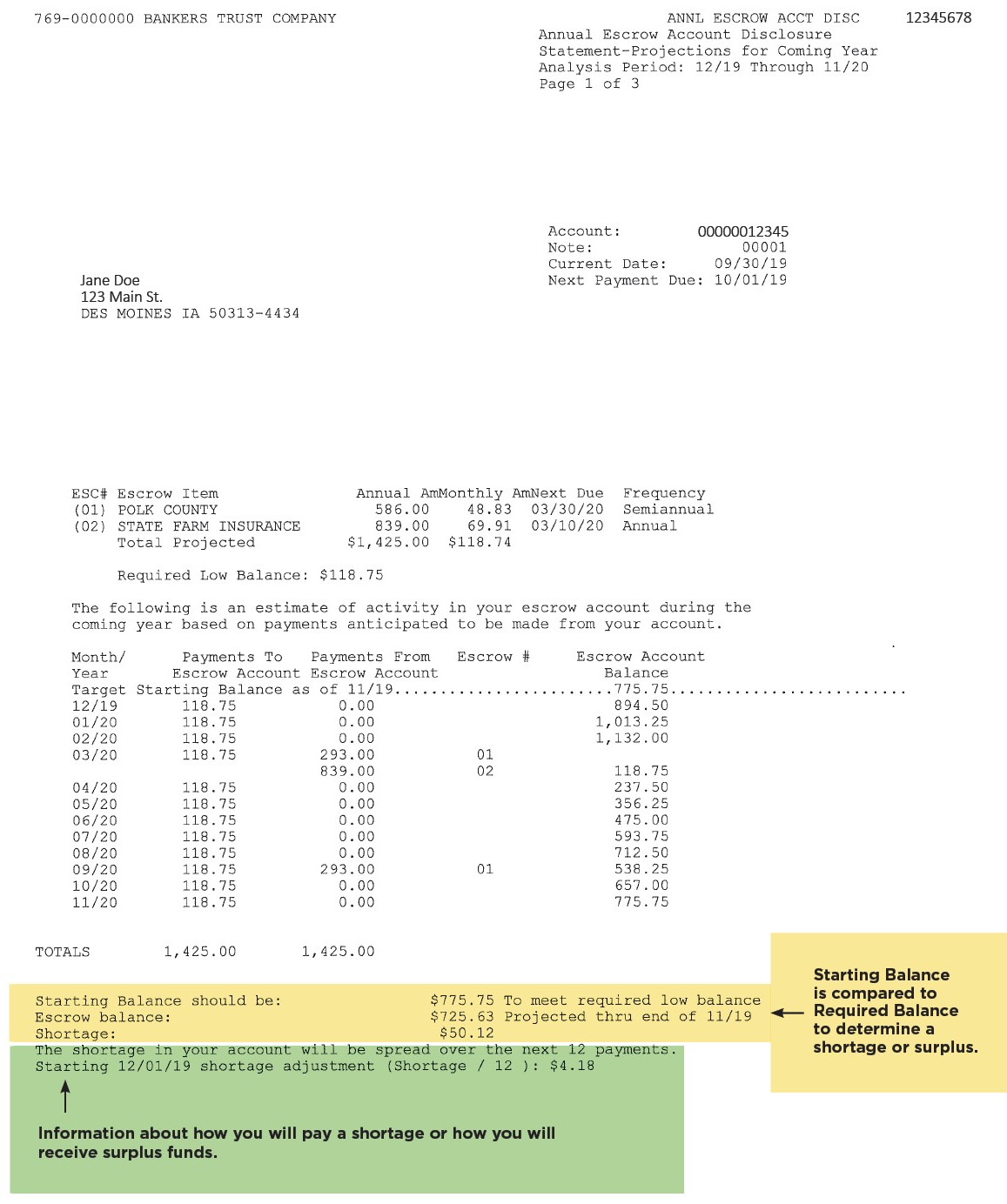

Page one: Escrow Projected Summary

The table in this section lists the expected account deposits and withdrawals for each month in the upcoming year. Below the table, your Beginning Balance is compared to your Required Balance to determine a shortage or surplus after payments are made. If there is a shortage or surplus, the section below will contain information about how you will pay a shortage or receive surplus funds.

Note that you do not need to take action for paying a shortage or receiving surplus funds. If your account shows a shortage, an adjustment will be made to spread the shortage over your next 12 payments. If your account shows a surplus, it will be automatically credited to you either on future payments or in the form of a check if the surplus is over $50.

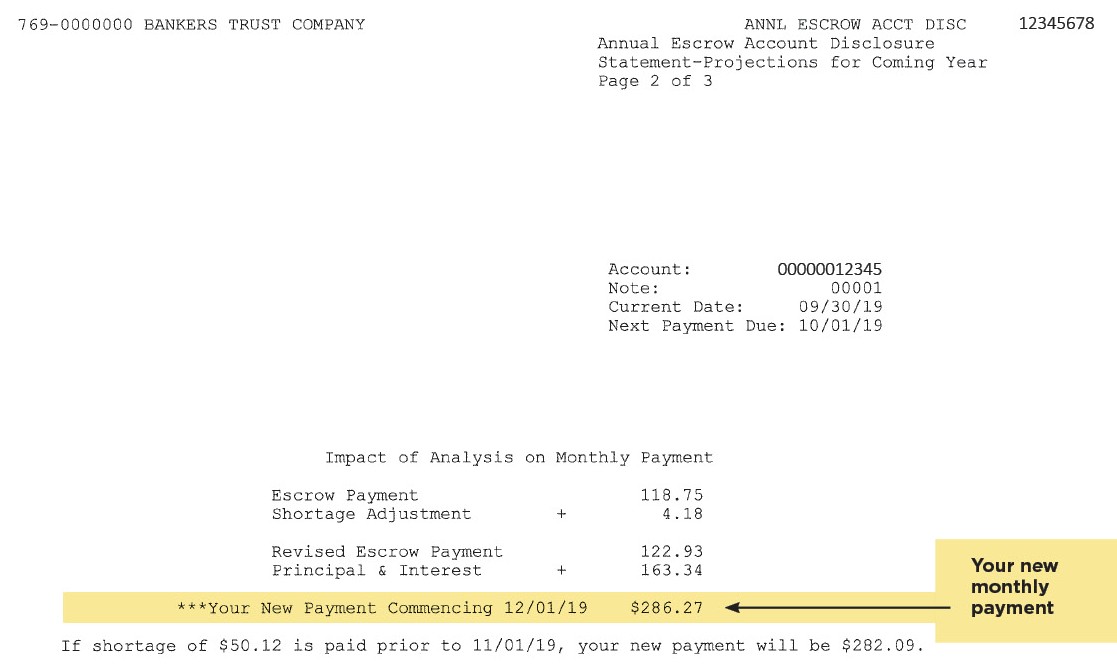

Page two: Payment Change

Based on new calculations of home insurance and tax, your monthly payment may change. On this page, you will find a breakdown of the changes, as well as your new expected payment.

Page three: Escrow Activity Summary for Prior Year

If the current year is not your first year of maintaining an escrow account, you will receive a summary of all account activity for the past 12 months on the final page of your statement. You may review this page to ensure accuracy and contact your lender if any payments seem off.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379