Planning for retirement early comes with numerous benefits, most importantly being that you know you’ll be prepared and financially secure when your retirement comes. While that may not be for 20, 30 or even 40 more years, it’s important to remember that retirement planning is all about the long game. And the long game applies to more than how early you start saving. You should also take a long-term approach when it comes to the funds your retirement plan is invested in. Let’s take a closer look.

Your retirement plan likely gives you the ability to invest in one or multiple funds so you may diversify your retirement account investments over several asset classes. Another popular option in many company sponsored retirement plans allows participants to select a target date fund. A target date fund allows you to select a single investment option based on your target retirement date, typically age 65. The portfolio of a target date fund is diversified within several asset categories. The general concept is the longer the time horizon to retirement, the more risk in the fund. As you age, the fund automatically and gradually becomes more conservative.

Here are a few things to keep in mind as you consider how best to approach your retirement portfolio with the long-term goal in mind:

- Understand your risk tolerance, and invest appropriately. Everybody’s risk tolerance is different depending on your point in life, how many years you have left until you retire, your personal comfort level with investing. There’s no right or wrong risk tolerance. Understanding where you stand will help you decide where your retirement funds are invested, ultimately allowing you to feel more at ease with your decisions.

- Make contributions regularly, and increase the amounts when you get raises and bonuses. Regardless of your risk tolerance, you can help your retirement account grow by setting aside a certain percentage of each paycheck, and increasing that percentage every year or each time you get a raise. A commonly recommended goal is to direct 10-15% of each paycheck to your retirement account. If your employer offers a matching contribution, make sure you’re taking full advantage of it by contributing at least the same percentage that is matched. Contribute as much as you are able.

- Don’t be too quick to change your allocations. Some people try to play the market, moving money around when certain funds go up or down. Unless you’re an avid follower of the stock market or a trained investment analyst (and even if you are), this is a tricky approach that usually results in you losing more money than you’ll gain. Funds rarely, if ever, go up in a straight line, so you’re better off leaving your money in one place for long periods and letting the market play out over time.

Are you saving enough?

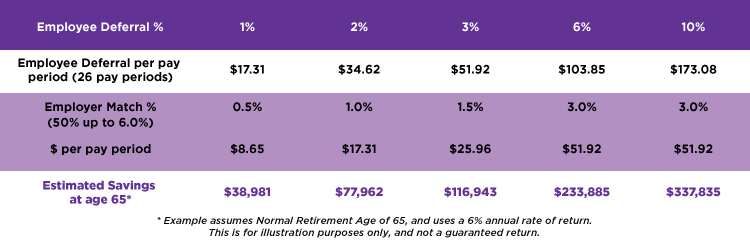

See illustrative example in the table below, assuming Employee Z is trying to decide how much to defer. She has an annual compensation of $45,000 and is 40 years old.

Staying the course with your retirement plan goes beyond frequently moving your money around. For example, taking out loans against your retirement account can also put a dent in – or significantly diminish – your retirement savings. If you’re in need of equity for a loan, be sure to consult with your tax advisor and banker beforehand to learn about the benefits and drawbacks.

No matter which route you choose, remember that saving for retirement takes time, but patience and consistency pays off when you’re finally ready to retire.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379