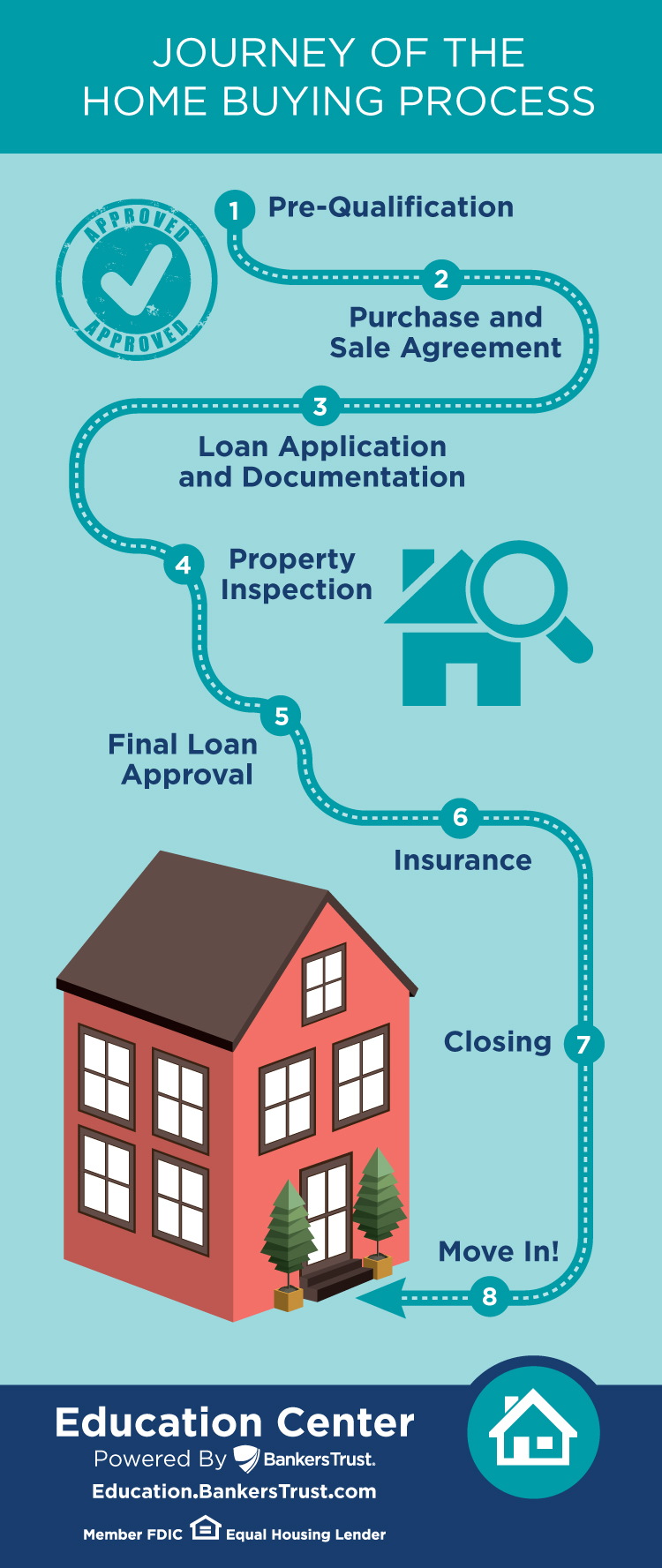

While every path to homeownership can be different, most follow a similar route. And, the more you know about homeownership, the easier it will be for you to become a homeowner. If you’ve had your eye on the market and are getting ready to officially begin your search, our infographic below will walk you through each step of the home buying process so you know what to expect along the way.

1. Pre-Qualification – Getting pre-qualified for a mortgage loan gives you an idea of how much you can afford based on your debt, income and credit history. The key to getting pre-qualified is to provide your entire credit history. Neglecting to mention outstanding loans or previous credit problems can nullify a pre-qualification. Plus, knowing how much you can afford will help you narrow your search since you will know which houses are in your price range.

2. Shop for a Home – Shopping for a home often involves comparing and examining many homes on the market. Most people shop for homes by working with a real estate agent, a trained professional who can help you find a home that fits your needs and budget. Your agent will take you to see the homes he or she thinks will interest you, based upon your wants and needs. This is the time when you and your family can explore new neighborhoods, visit many different kinds of homes and compare features. Take your time, look at many houses, take notes and ask questions. Once you narrow your choices to a few houses, take a closer look.

3. Offer and Sale Agreement – When you find the right home, you will work with your agent to negotiate the terms of the sale, including the sale price, requests, move-in date, etc. Then, your agent will present your offer to the sellers. The offer is a written proposal to purchase the property and is usually accompanied by earnest money, a deposit to show your intent to complete the transaction.

In some states, if a seller accepts the offer, the signed proposal becomes the purchase contract. In other states, your real estate agent or settlement attorney will prepare a real estate purchase contract that includes all the terms you and the seller have agreed to in the offer. Once you and the seller sign the offer, you have a binding contract. The contract to purchase a home should allow you to cancel the transaction and get your money back if a professional inspection reveals problems with the house, if you are unable to secure financing, or if other conditions or contingencies written in the contract are not met.

4. Loan Application and Documentation – Once the seller accepts your offer, you will need to obtain your mortgage. To do so, you will need to complete a loan application and provide documentation. Information commonly sought includes pay stubs, two years’ tax returns and account statements verifying the source of the down payment, funds to close and reserves.

5. Property Inspection and Appraisal – As soon as possible after your offer has been accepted, you should hire a licensed home inspector to check the structural soundness and safety of the property. If the inspection shows any major problems, you can cancel the sale and your earnest money will be returned to you. If you don’t want to cancel, you can ask the seller to make repairs, or the seller can give you a credit for the amount it would cost to make the repairs. Since the buyer is not allowed to receive cash back from the seller, the credit can be used toward paying your closing costs, but it cannot be used toward your down payment.

Once the home inspection repairs, if any, have been negotiated, you are ready to notify your lender to order the appraisal. If possible, order the appraisal after the home inspection is complete, so you are not responsible for the appraisal fee if you decide not to move forward with the purchase after reviewing the home inspection. Sometimes the “preferred timing” of obtaining a home inspection prior to ordering the appraisal may not be possible given contract restrictions.

6. Final Loan Processing and Approval – Your loan will go through two reviews. First is the processor’s review, in which the loan processor will package all pertinent information to be sent to the underwriter. Then your loan moves on to the underwriter’s review. Based upon the information put together by both the loan representative and the processor, the underwriter makes the final decision on whether or not a loan is approved. In most cases, when your credit and debt-to-income is good, your loan will be approved with little or no problem.

7. Insurance and Title Search – Between the time the seller accepts your offer and the sale closes, your contract is pending, or in escrow. Prior to closing, you will be responsible for obtaining a homeowner’s insurance policy to protect your home against casualty and liability. During the escrow period, a title company or attorney will conduct a title search to verify proof of ownership and clear title to the property you are purchasing. As a buyer, you will be required to purchase an owner’s title insurance policy, which is issued to protect the lender against defects in the title. The owner’s title insurance provides protection against any claims on the home from before you purchased it.

If your down payment is less than 20 percent of the home’s sale price, many lenders require borrowers to carry Private Mortgage Insurance, also known as PMI. Even if a loan meets the standards of a lender, a mortgage insurance company could choose to deny coverage, so be sure to ask your lender about PMI.

8. Closing – The close of escrow, or settlement date, is the date on which your down payment and closing costs must be received and the title to the property is transferred from the seller to the buyer. In some states, the closing is a formal meeting at which both the buyer and the seller must sign the final paperwork that is required for the sale. In other states, the final paperwork is signed in advance and the closing is handled by the title company or attorney. Generally, the seller moves out of the home and turns the keys over to the buyer on the day of closing.

9. Move In – After the closing is complete, you will receive the keys and are finally able to move in to your new home!

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379