While mobile deposits are a convenient way to deposit your payroll or personal checks anytime and from anywhere, there are a few things you should keep in mind to prevent becoming a victim of a mobile deposit scam. Here’s a breakdown of what a mobile deposit is, how mobile deposit scams work and how you can protect yourself from falling victim to one.

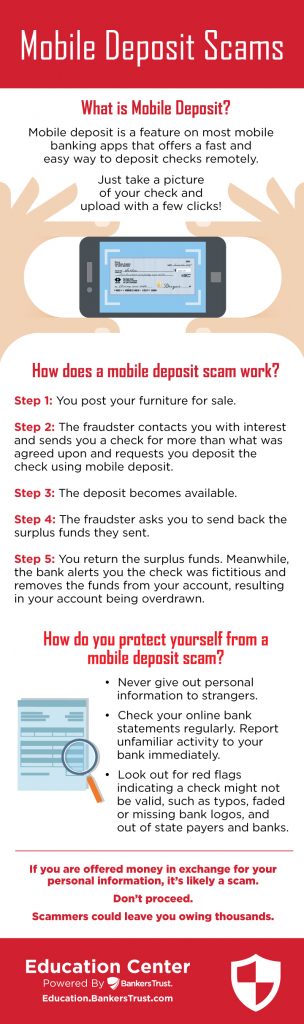

What is Mobile Deposit?

Mobile banking apps with the Mobile Deposit feature can save you a trip to the bank and allow you to deposit checks whenever is most convenient for you. Just take a picture of the front and back of the check and upload!

How does a Mobile Deposit scam work?

Fraudsters contact their victims through email or social media posing as a potential employer, lender, or interested buyer on a marketplace site. The fraudster will often provide the victim an opportunity to earn money quickly by depositing a check to their account or by asking for help in moving money from overseas. The fraudster will further request the victim’s bank account information and may even ask for online or mobile banking login credentials.

The fraudster uses the information to deposit a fake check. Once the deposit has been made, the scammer will request funds to be immediately transferred back to them via money order, person to person transfer, wire transfer, reloadable cards or even gift cards. Once the victim returns the funds, the bank alerts the victim that the check was fictitious and removes the funds from the account, causing a loss to the victim.

How do you protect yourself from a Mobile Deposit scam?

Never give out your personal information to people you don’t know, alert your bank of any suspicious activity, and before you deposit a check, look for these red flags:

- Typos in names of the payer, payee, bank and dollar amounts

- Out of state payers and out of state banks

- Missing or faded bank logos

- Notations in the memo-line suggesting legitimacy (cash, authorization, void after 30 days, payment, etc.)

And remember, even if a check has been “cleared,” you may not be in the clear. Under federal law, banks must make deposited funds available quickly, but just because you can withdraw the money doesn’t mean the check is valid, even if it’s a cashier’s check or money order. If you have any questions about whether or not the check is valid, talk to your banker.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379