NOTE: This article was last updated on February 15, 2019, to include provisions of the SECURE Act passed into law December 20, 2019.

Individual Retirement Arrangements, or IRAs, are common retirement plans. Traditionally, IRAs aren’t funded by employers, which makes the plan appealing to individuals without employee-sponsored plans or are self-employed. Investing in IRAs is common among individuals with employer-sponsored plans seeking additional retirement savings.

It’s important to know when and how much to invest in order to get the most out of your plan. Consider what time of year is best for you to invest in your IRA, how much you can contribute to maximize your return on investment, or ROI, the differences between a Traditional and Roth IRA, and the benefits.

When and how much should you invest in an IRA?

Financial experts have varying viewpoints on when and how much to invest. For some, they’ll suggest early January with the belief prices are lower during the beginning of the year, providing a greater chance at investing before stock appreciation. Investing early in the year also means your contribution will have the maximum time to gain returns and grow. Therefore, investing the maximum amount, which is $6,000 (or $7,000 for individuals over 50) at the start of the year, often means you get the most out of your investment.

However, if investing $6,000 within the first few weeks of the year isn’t possible, or you’re a risk adverse client, dollar cost averaging, or DCA, allows you to make contributions throughout the year. For the budget conscious, DCA allows individuals to plan consistent monthly contributions and increases the opportunity to invest during unexpected market declines.

What’s the difference between a Traditional IRA and Roth IRA?

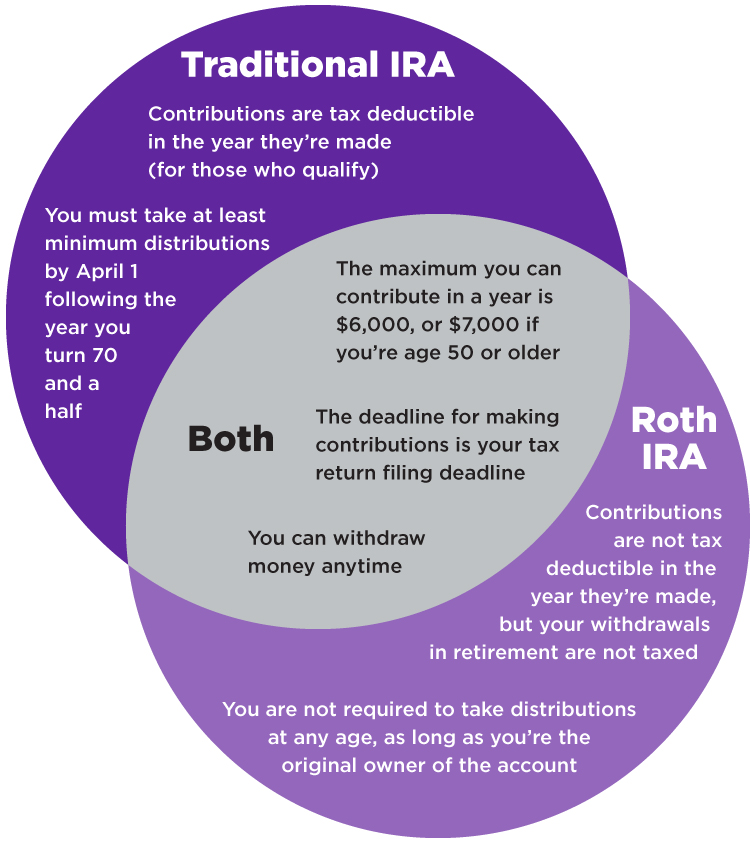

When opening an IRA, you have two options: a Traditional IRA and a Roth IRA. Here’s a breakdown of their differences and similarities.

Source: IRS.gov

What are the benefits of investing in an IRA?

In addition to the tax treatments each provides tangible benefits, such as first-time-home-buyer, qualified education or hardship withdrawal expenses. Typically, IRAs are less restrictive than other retirement plan options, such as 401(k)s. This means you can choose from a variety of providers and investment options, whereas 401(k)s are often limited to employer provided options.

With multiple options within your IRA, it’s important to understand the basics of asset allocation in order to build a balanced investment portfolio. It’s also important to have an idea of how much income you will need in retirement and how long your retirement savings will last. Be sure to check out our retirement financial calculators to find answers to both of these questions.

NOTE:

Since the publishing of this article, the SECURE Act was signed into law on December 20, 2019 which includes a change to the timing of RMDs for those who have not yet attained age 70 ½ or who have not yet commenced RMDs.

Effective for distributions required to be made after December 31, 2019, the Required Beginning Date for Required Minimum Distribution, for non-5% company owners, is April 1 following the later of the calendar year in which the employee attains age 72 or retires. For an employee who is a 5% owner, the Required Beginning Date is the April 1 following the calendar year in which the employee attains age 72, even if the employee continues to work past age 72.

If a participant dies before the Required Beginning Date and the spouse is the participant’s beneficiary, the spouse will be able to delay distributions until the December 31 of the year in which the decedent would have attained age 72.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379