A recent study found that just 1% of kids who earn an allowance save any of their allowance money. Parents can help change those behaviors by starting early to teach commonsense financial responsibility. Teaching valuable lessons in money management must be a consistent practice and start at an early age. Here are five tips to help you teach young children about money.

1. Provide A Reasonable Allowance

Rather than buying items for children outright, set up an allowance. The amount and how it’s earned should be clear from the start so they know exactly what needs to be done and how much they’ll make. If they ask for something, they’ll need to use what is available from allowance money to purchase it. They may decide what they wanted isn’t worth it if they have to spend their own money. It’s important not to step in and buy what they want when they can’t afford it. This teaches a valuable lesson in deprivation and what can result from spending all their money and not having enough to buy something else they may want. Having children think about a specific item to save for will motivate them to put money in savings to buy it later.

How much should you pay your child for an allowance? Some parents think household chores should be done without pay, while others pay for every assigned task the child completes. A good compromise is to pay for basic chores as an incentive to earn spending money. Some examples are sweeping, pulling weeds, raking leaves, putting away clothes and other helpful tasks. A customary amount today is about $3 per hour.

2. Avoid Free Spending

While easier in some situations, refrain from giving kids money anytime they ask. As a parent, you have the right to say no to a request for money just as you do to other things you don’t want your child to have. Even if you can afford to give money freely, kids should have choices and limits. This lesson gives children an awareness of money and its purchasing power. When the opportunity comes to buy an item, you can explain all the options to them so they can review the pros and cons and make a decision to buy now or save for something else later. A conversation about needs and wants helps prevent impulse purchases and sets up a more planned approach to spending. If a child asks for something while shopping, remind them of what they have available to spend and, if it’s not enough, that they’ll have to wait until enough money is saved.

3. Open A Kids’ Savings Account

Start kids early on learning how a bank operates and what happens to their money. Many banks have a minor savings account with perks to encourage kids to save. A banker can help explain financial terminology and set expectations for saving. Visiting the bank to make deposits and withdrawals, reviewing bank statements, and understanding interest growth are all ways kids learn the money management process. Some younger kids may not completely understand the concept of compound interest, but you are planting seeds that will eventually be realized. You can help inspire additional savings by verbally praising your children for money saved. For larger amounts deposited or when certain balances are met, you could reward the child with a perk of your own, such as an extra half hour of screen time.

4. Allocate Money For Giving

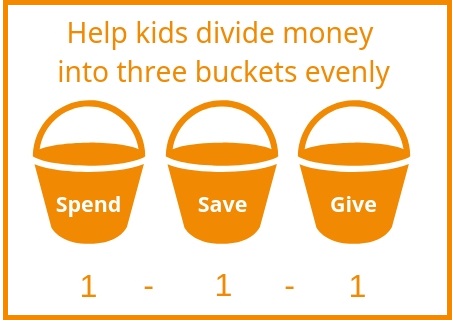

Encouraging children to spend, save, and give in equal measure is a great way to develop financial discipline. While kids will ultimately grasp the habit of saving some of their money, it’s important to also help them understand the importance of charitable giving. A common guideline referred to as the 1-1-1 rule divides all money acquired into three buckets evenly, with one bucket dedicated to a worthy cause. Once money has accumulated in the giving bucket, involve the child to decide on a receiving organization and deliver the donation. Depending on the age, the child could research a charitable cause and present their findings to you. It’s a great way to start them thinking about others and the good work charities are doing in the community.

5. Lead By Example

You are a visible role model for your kids, and they are always watching. It’s important to speak openly about money around your kids and show that it’s possible to live within your means. Explain consistently what you are doing and why you are doing it so they’ll understand the motivation. It only takes a few seconds to explain to kids why you made a particular purchase, such as choosing a generic brand over a name-brand product. Many routine activities are great opportunities to teach a lesson about money matters. If your goal is to prepare your child for financial responsibility, your actions should be teaching moments so they can learn to make smart choices.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379