One mortgage financing technique you might have heard of is the mortgage interest rate buydown option, also referred to as “paying discount points.” This is a one-time fee paid at closing that lowers your interest rate, either temporarily or for the entirety of the loan term.

While lowering your monthly mortgage payment might seem like a no-brainer at first, there are several items to consider before deciding to pay discount points.

What is your break-even point?

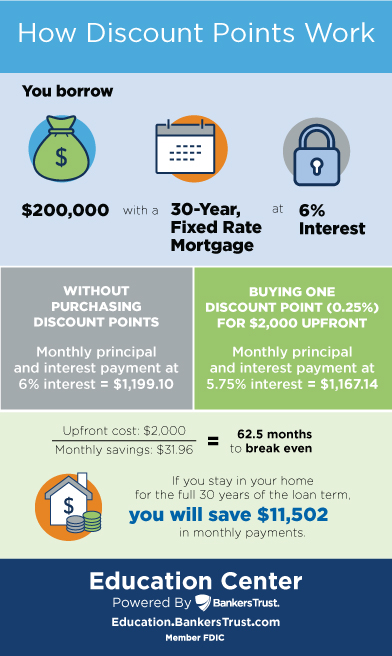

Mortgage buydown is an expensive option, so it’s important to determine the point at which your interest savings will outweigh the upfront buydown cost.

The cost of permanent interest rate buydown varies based on your lender and loan amount. Generally, each discount point costs 1% of the loan amount and will reduce your interest rate by approximately 0.25%. This means you would need to buy four points to lower your interest rate by one percent.

For example:

Is your seller or builder offering to buy discount points?

Most buydowns are negotiated between buyers and lenders, though sellers and builders can also purchase discount points to lower the buyer’s interest rate. This is especially common in slower markets, as sellers and builders are typically more motivated to attract buyers. It’s worth inquiring about this possibility, as there is little to consider when someone else shoulders this cost.

Which structure would be most advantageous for you?

As mentioned above, mortgage buydowns have either a temporary or permanent structure. Temporary structures lower the interest rate to a certain percentage, then increase each year until it returns to the original rate.

Temporary options include:

- 1-0 buydown: Interest rate is 1% lower than the original rate for the first year.

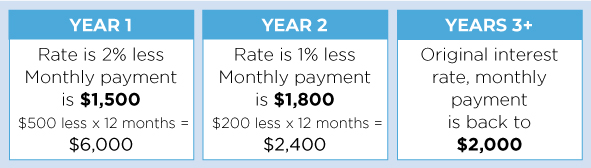

- 2-1 buydown: Interest rate is 2% lower for the first year and 1% lower for the second.

- 3-2-1 buydown: Interest rate is 3% lower for the first year, 2% lower the second and 1% lower the third.

For example, let’s say your mortgage payment is $2,000/month. Your seller or builder pays $8,400 upfront for a 2-1 buydown. You save $8,400 in monthly payments over the first two years, as shown below:

What upcoming changes or decisions do you anticipate?

The purpose of a mortgage buydown is to pay more money up front so you can save money in the long run. If you anticipate refinancing your loan when rates drop or moving again in the near future, you likely won’t realize any savings that should result from the money you paid up front. In these cases, a temporary mortgage buydown might not be the best option.

If you currently have extra liquidity or anticipate your household income will increase significantly in the next few years, it’s definitely worth looking into the temporary mortgage buydown option.

Proceed with caution

I encourage prospective homebuyers to ask their lender about the mortgage buydown options, but to remain cautious and consider other alternatives for lowering your monthly mortgage payment. One tried-and-true option I recommend is making a larger down payment, which allows you to maximize your loan-to-value, build equity more quickly, and decrease or eliminate mortgage insurance premiums.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379