Renting versus buying a house. It’s a decision that almost everyone faces at some point in their lives. When considering this question, there’s one point I always stress: make sure you fully research and understand the pros and cons associated with both options in your market before making your decision. Let’s take a brief look at some of the major factors when it comes to renting versus buying.

Renting a House or Apartment

Of course, there are benefits to renting depending on your situation. For example, if you know you’ll only be in a certain location for a year or two or you live in a high-cost market, it likely makes more sense to rent.

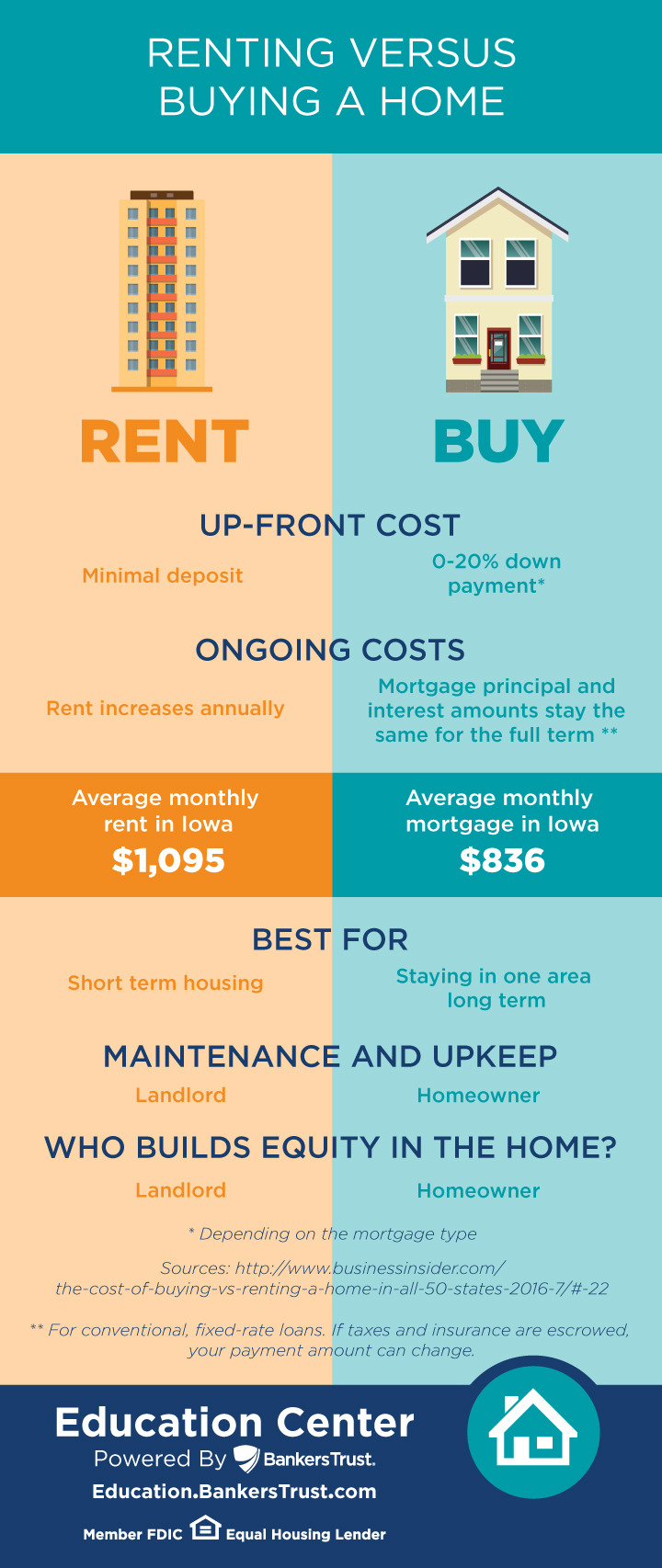

The expense of purchasing a home is perhaps the No. 1 thing that keeps people from buying. It’s not just the down payment, though. Being a home owner involves a number of expenses that you may not pay if you’re renting, such as lawn mowers, shovels, homeowners insurance and property taxes. However, keep in mind that these total costs can even out over time. How long it takes for owning to become less expensive than renting depends on your market – but in Iowa, this could be just a few years.

Another perk of renting is that your landlord takes care of anything from changing HVAC filters to fixing broken pipes. While as a home owner you’re responsible for taking care of the house yourself, you’ll also be the one who gets to make decisions regarding which products are used, how quickly things are fixed, and making the home your own, which can be gratifying.

Buying a Home

When considering whether to buy a home, many people think they’re not qualified or that they don’t have enough money for a down payment. Most of the time, this is not the case. When it comes to down payments, you’ve probably heard that 20% down is preferred, but some mortgage loans enable you to pay as low as 3% down, and others yet allow 100% financing (0% down). If 3% is your target, KCM reports that most first-time home buyers can save for a 3% down payment in less than two years. Learn more about down payment requirements in our previous article.

One of the nice parts of having a fixed-rate mortgage is that you know exactly what the principal and interest of your monthly mortgage payment will be the first month and the last month, which is typically 15 or 30 years down the road. Not only does this help you better budget and estimate your costs in the long term, you also don’t have to worry about the annual increases most renters face. While knowing this cost is handy, remember that your property taxes and homeowners insurance could still fluctuate year-to-year.

Additionally and arguably the biggest benefit of homeownership, is building equity. Owning a home means you’re building equity that you can take advantage of in the future, whether through loans or when it’s time to sell. When you compare the long term investment of renting versus buying, you’ll often find that buying really pays off in the long run.

Full disclosure: I’m a mortgage loan originator, so of course I like when people buy houses. But not just because it’s good business for me – buying a home is both a great accomplishment and a smart investment for many people.

Equal Housing Lender. SBA Preferred Lender. NMLS #440379

Equal Housing Lender. SBA Preferred Lender. NMLS #440379